Tokenovate empowers financial institutions to simplify and automate the entire post-trade and collateral lifecycle, cutting costs, reducing risk, and unlocking growth.

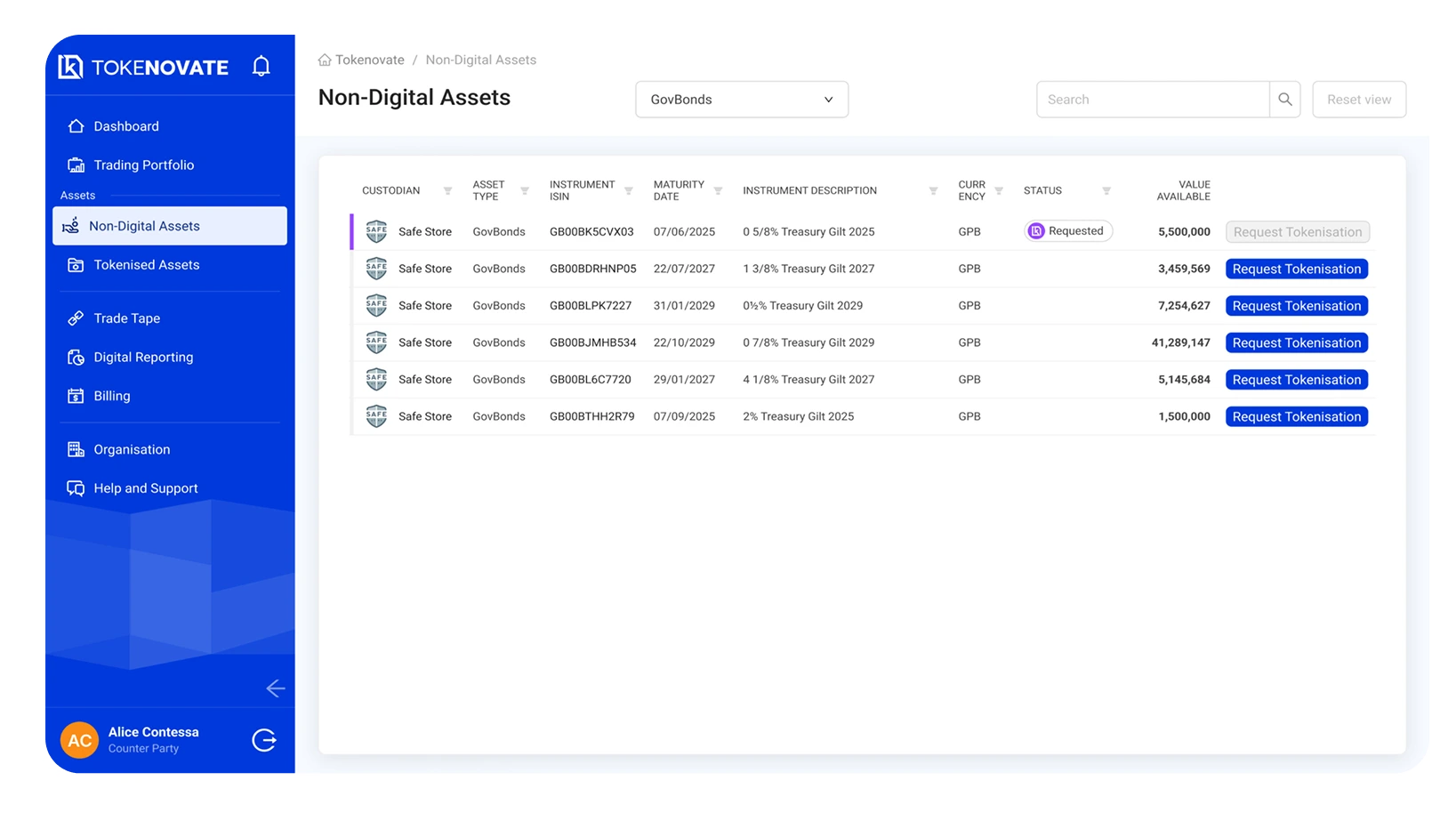

Our platform turns complex contracts into simple step-by-step instructions, creating automated workflows for efficient collateral mobility and post-trade lifecycle management. We deliver a unified experience across all asset classes, products, and infrastructures, regardless of how or where you trade. Built to be data agnostic, our services are interoperable by design.

By embedding the Common Domain Model into the core of our technology, we turn contracts into code, leveraging blockchain, composability and tokenisation to bring precision, automation, and scalability to every step of the post-trade process.