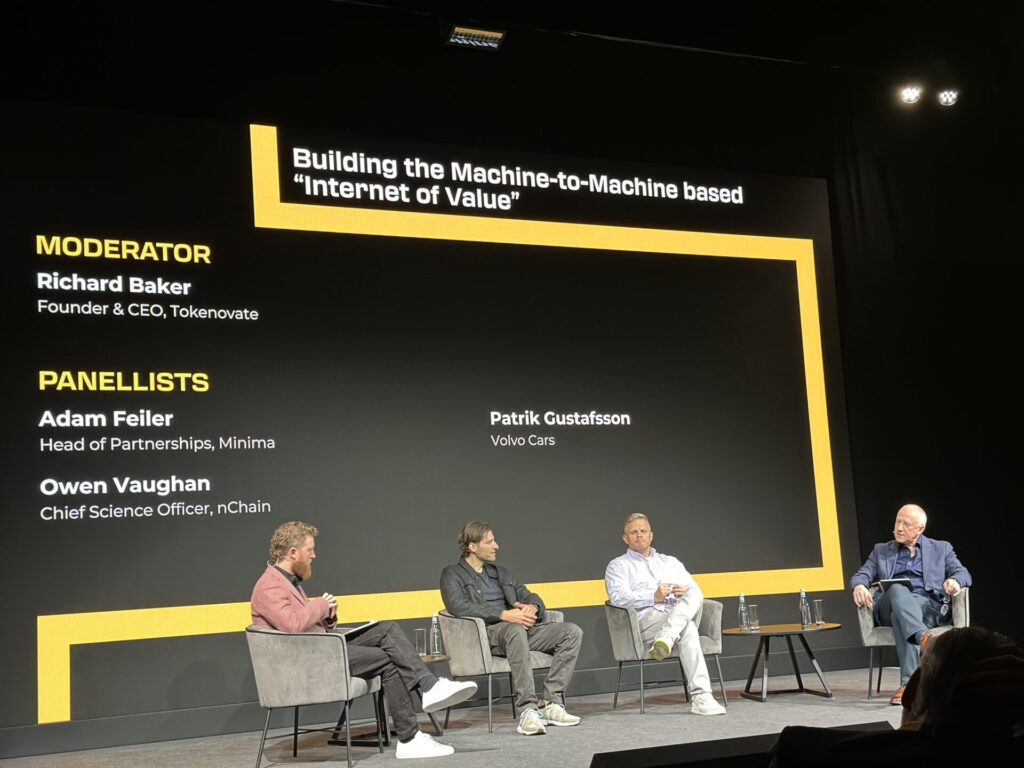

Our first day at the London Blockchain Conference ended on a high with an excellent panel discussion on “Building the Machine-to-Machine based “Internet of Value” moderated by our founder and CEO Richard Baker. A fascinating discussion with Patrik Gustafsson, Volvo Cars, Dr. Owen Vaughan, nChain and Professor Adam Feiler, Minima, traversed the new 3.0 world of a truly hyperconnected digital environment, the new ‘dePIN’ approach to amalgamating physical hardware, software and decentralised services and the future prospect of cars that not only communicate with each other but might have programmable paint that could be changed to reflect the mood of the driver!

To give some perspective to the advances in digital hyper connectivity and interaction from the world of Web 1.0 and 2.0 to where we are today, an estimated 15 billion devices are already connected in the ‘Internet of Things’, and in Minima’s case, an entire blockchain can be put on a mobile device without any mining or staking.

The essential technological leap that comes with Web 3.0 is the decentralisation and transfer of data ownership from centrally managed information stores back to individuals – and according to Volvo, potentially to machines like cars themselves. (For instance, to automatically pay tolls or parking charges). Alongside this is the shift in ‘value exchange’ where value is intrinsically linked to the hardware, software and services themselves, and realised directly, for example in the form of micropayments for WiFi connectivity so users pay “for the value provided” rather than fixed service fees regardless of actual usage. Similarly, households with an EV (electric vehicle) charging point could let others use it and receive micropayments directly.

“The possibilities are endless, going all the way to embedded microsystems at machine level – a true game changer for a connected world”. Taking back data ownership is huge – and alongside technologies like blockchain that create an immutable record of events – will go a long way to preventing unauthorised data sharing. Back to the car thing, it could also be incredibly useful in ‘proving’ not only that an event happened, but exactly where it happened (by linking it to geophysical data points), supporting potential ‘moment in time’ insurance coverage.

While agreeing there is still some way to go to achieve true digital identity, the panellists observed that in the next five years we will see the establishment of ‘global’ standards and protocols in ‘machine to machine’ interoperability – a new language enabling more seamless communication and value exchange between even the smallest hardware and service components; that one or a few blockchains will win and become dominant and that there will be further and greater tokenisation of assets to facilitate value exchange, for example, enabling individuals to sell their own data.