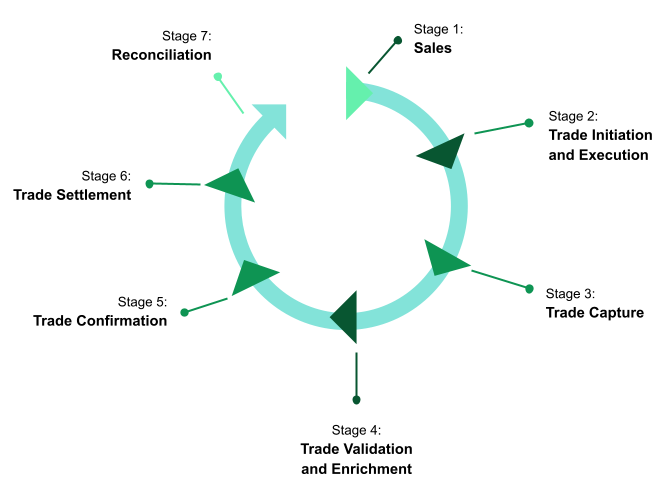

The Basic Derivative Trade Lifecycle

The blockchain, as known as Distributed Ledger Technology (DLT), can revolutionise the derivative markets, ranging from transforming the trade lifecycle to tokenising the underlying assets. In whatever way DLT is adopted, it ensures an immutable, transparent, tamper-proof record of the transaction. Regardless of the underlying asset class, the majority of financial derivatives follow the 7-stage basic trade lifecycle shown below:

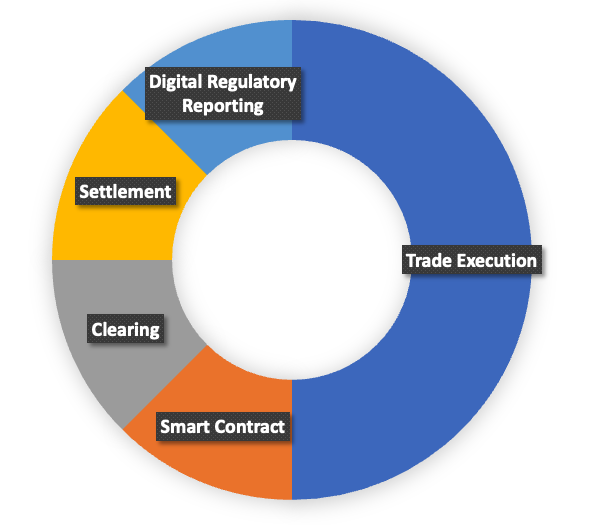

The Alternative Derivative Trade Lifecycle using DLT

With the use of DLT, the number of stages in the lifecycle can be reduced, even if a new stage is added: the much-wanted Digital Regulatory Reporting (DRR).

The five stages of an alternative derivative trade lifecycle using DLT are:

- Trade Execution: Buyers and Sellers can directly trade on the blockchain without the need for intermediaries. The agreed trade details that are traditionally summarised in a ‘Term Sheet’ are recorded directly on the Ledger. The sales, trade execution, trade capture, trade enrichment can all be combined into a single step eliminating the need of various post trade steps taken to mitigate risk by Middle Office and Operations teams.

- Smart Contracts: At present derivative trades between parties are typically confirmed by the parties to a trade drafting and signing a ISDA confirmation for the trade. These short form contracts are drafted by Legal or Operations teams, and are an additional cost to internal cost centres. DLT allows the contractual trade details, agreed at the time of execution, to be encoded directly into a smart contract. Smart contracts are self-executing programs which will automatically enforce the agreed terms.

- Trade Settlement: Trade settlement involves the transfer of funds or assets during the lifecycle of a trade on predetermined dates until the trade is early terminated or matures. Fund transfers can be made directly to the participant party accounts or to custodians appointed by them. In addition, if the trade requires the delivery of an underlying asset such as shares or gold, it is simply possible to transfer the ownership of the asset on the blockchain instead of a physical delivery or the need of an intermediary custodian.

- Trade Clearing: If trade clearing is applicable for the trade type, typically for exchange trades, trades must be cleared – validated, verified and settled through a Central Counterparty. Trade details can be directly verified by the Ledger or the smart contract.

- Digital Regulatory Reporting: An additional feature which DLT allows is for the digital reporting of trade data for regulatory purposes. Most financial counterparties who are subject to regulatory reporting under derivative trading obligations must provide trade details on their positions to their local financial authority. At present, often due to internal systems being archaic and regulatory regimes being imposed relatively recently, firms have needed to create new work-arounds and processes to manage and sort the voluminous data they are legally obliged to send and then further reconcile their submissions to the repository. DLT allows for the automation of financial data reporting in a standardisation format for the purposes of validation and reconciliation directly from the blockchain. Most regulatory authorities are encouraging the markets to move towards digital reporting to ensure accuracy, efficiency and real time reporting e.g. CFTC.

To conclude, by embracing DLT the financial market can simplify the derivative trade lifecycle and introduce more resilient and transparent reporting. A win for everyone involved!