The Trading Lifecycle

Trading can take many forms. At its core, a trade is when two counterparties – the buyer and seller – engage in a transaction. But that’s a very simplified description.

In reality, particularly in financial services, a trade is a highly complex activity. It involves several stages and multiple stakeholders.

The lifecycle of a trade is a process littered with actions that are triggered by events and must be completed by those involved. And these actions and events are often subject to manual processes, which in turn lead to costly inefficiencies, incomplete and incorrect information collection and reporting.

Tokenovate’s platform for decentralised financial market infrastructure, and smart contracts, addresses these problems through enabling programmatic trade lifecycle management of the pre-trade to post-trade workflow for OTC and Exchange traded derivatives.

Pre-Trade

In the first stage of a trade, which takes place before the transaction, essential preparations are carried out. From client onboarding or Know Your Customer (KYC), via collection and management of appropriate collaterals, to agreeing legal frameworks such as ISDA documentation. Risks are evaluated and understood. Once this stage is completed, you are ready to trade.

For Tokenovate this is where we liaise with our customers to set up the appropriate infrastructure using the blockchain, including tokenisation, fractionalising and ensuring the workflow is integrated.

Trade Execution

This is a comparatively simple step: negotiations between counterparties take place, often via a broker, and once terms have been agreed, the trade takes place. It can happen on exchanges, over the counter (OTC) or off-venue.

Trade Management

The third stage introduces a set of steps which adds considerable complexity. Now the trade must be managed. Just because a trade has happened doesn’t mean it’s fully executed: the ongoing process of clearing, settling and reporting starts.

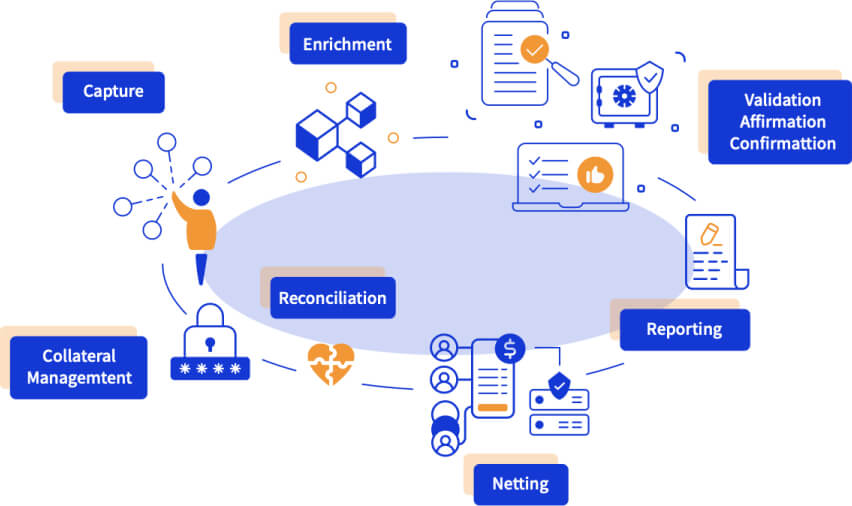

The trade management stage involves several crucial actions: capturing, enriching, validation, affirmation, confirmation, reporting, netting, reconciliation and collateral management.

It is at this stage that Tokenovate’s digital financial market infrastructure solution performs much of its hidden magic.

The platform automates the execution of contractual obligations through smart derivative contracts. And our “digital twin” approach (eg. the creation of an identical digital representation of an underlying asset) to collaterals, for example, is continuously synchronising states between the “real-world” and the digital world.

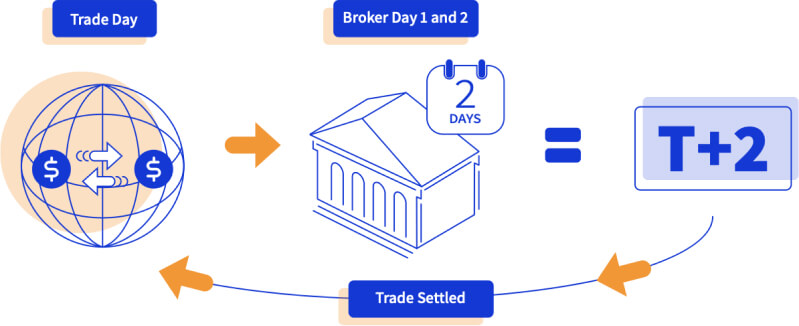

Trade Settlement

Once the trade has been cleared, settlement takes place. This is when the actual exchange of value occurs. Here the T+2 settlement cycle is prevalent, and it is in fact one of the major headaches of a trade. The T+2 cycle refers to the time it takes from a trade (T) taking place to the time in days it takes before the transaction is settled (+2).

There are several reasons for why it takes two days to settle. Fragmented and siloed databases and infrastructure, coupled with highly manual processes, inevitably introduce time-lags.

It also creates situations where information is incomplete or incorrect that further delays the process. Read more about this in our blog about The Trouble with T+2.

Tokenovate’s decentralised market financial infrastructure (dMFI) platform is developed with the blockchain as a key component. It serves as a global single source of truth, and the smart derivative contracts solution autonomously manages and executes events of a trade. We believe this will enable the industry to accelerate the move towards instant trade settlement.

Position and Risk Management

The final lifecycle stage of a trade is a continuous process of managing positions and risks. Institutions and counterparties need to manage their held positions (often referred to as the trading book) to make sure the combined exposure is acceptable and legal.

In the end, a collaborative and standardised approach to remove siloed infrastructures, and put both money and assets on the same rail, will make it possible to further streamline processes, achieve efficiencies and reduce time to settlement.